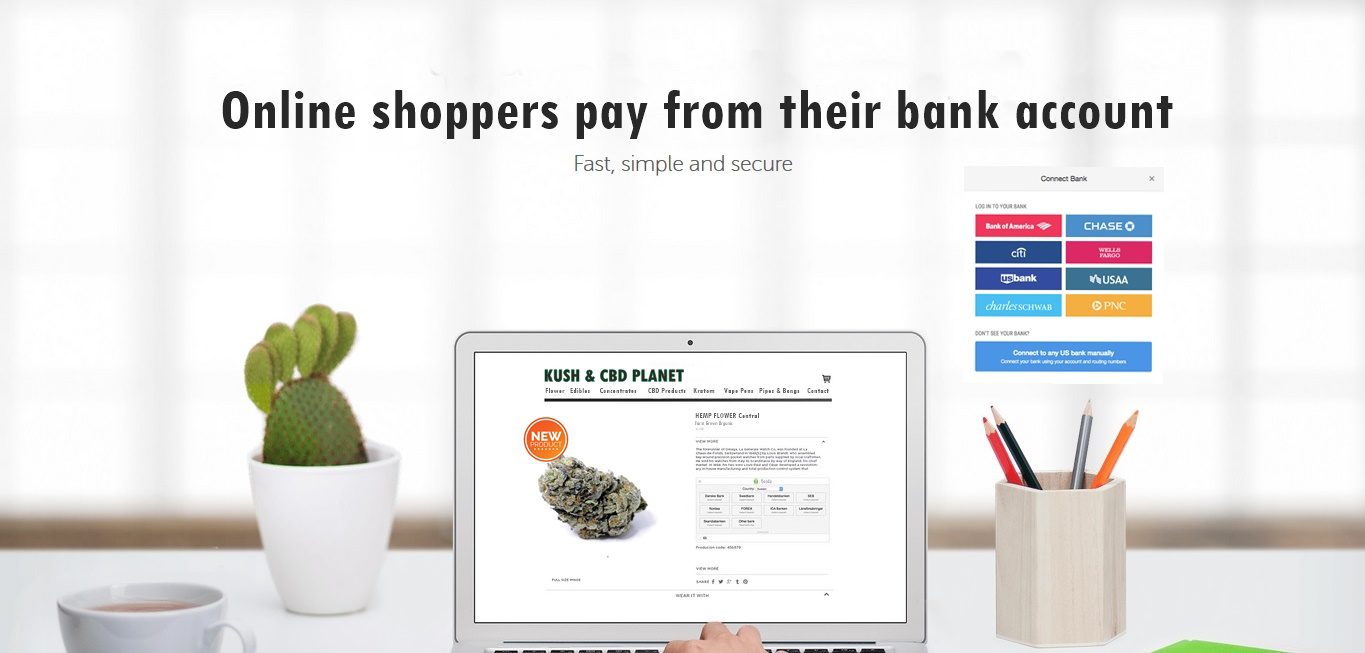

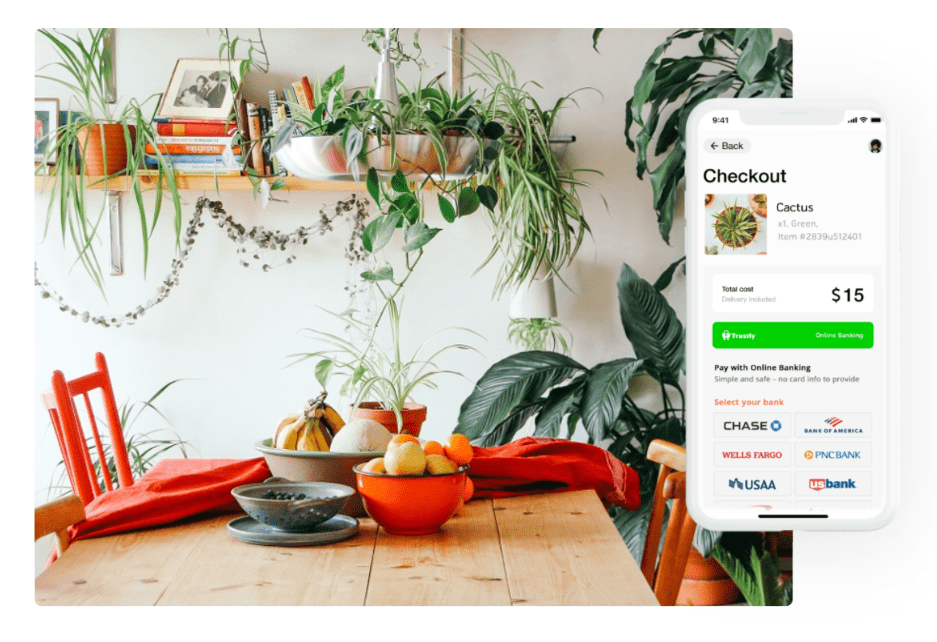

Pay-by-Bank is a is a peer-to-peer payment method that lets website visitors checkout and make payments directly from their bank account instead of a credit card.

Meet Pay-By-Bank technology, an Open Banking payment processing solution that’s growing in popularity within the high-risk payments’ industry.

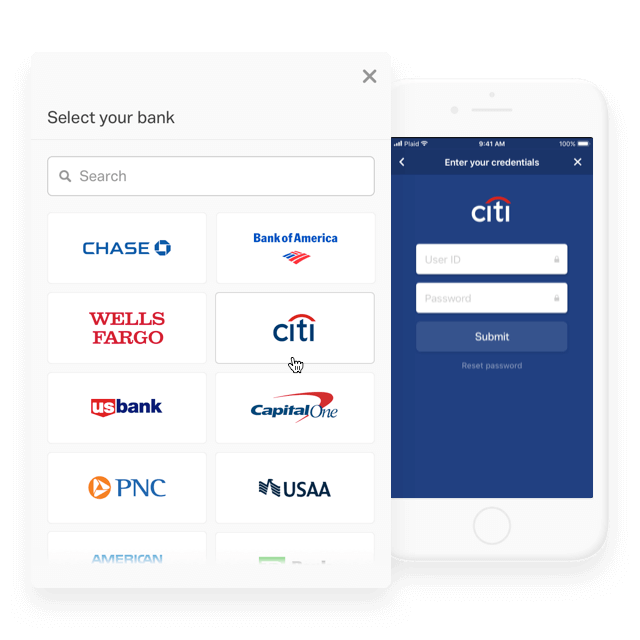

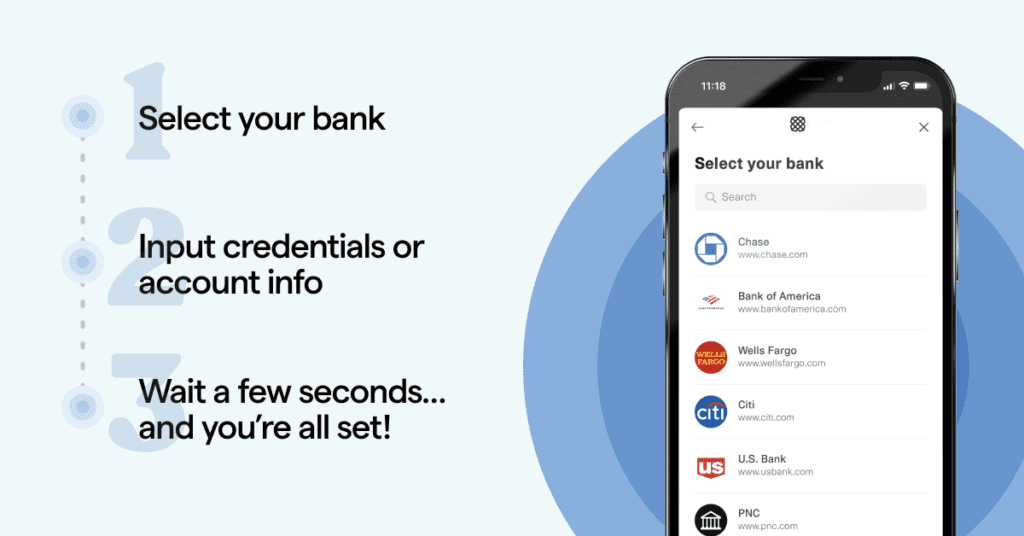

How Does It Work?

2. Customers will see the same interface you’d see if you were to log in to your own bank’s online portal.

3. After logging into their bank account, a buyer confirms the purchase amount and presses the 'Accept' button. Transactions are completed within seconds.

4. Funds settle into the merchant's bank account on the same day or the next business day. AML & KYC compliance are built into the platform for you!

Acceptable Industries

- Adult Entertainment

- SEO & Digital Marketing

- Recurring Subcriptions

- MMJ/Cannabis Dispensaries

- Restaurant Take-out & Delivery

- Coaching Seminars

- Nutraceuticals/Pharmaceuticals

- Hospitality & Travel

- Cryptocurrency & MLM

- Vape Shops & Kratom

- Age-restricted goods

- Freelancers & Sole Proprietors

- Telemarketing

- Future Events Ticket Brokers

- Computer Repair & Maintenance

- Online Pharmacies

- Loans & Credit Repair

- Landscapers, Electricians & Contractors

Rates & Fees

Same Day Approval

$

5

00

Monthly Recurring Fee -

Same Day Approval: We approve all legal businesses within one business day. No credit check is required. Businesses placed on the "Match List" by payment processors are gladly accepted. No exceptions.

-

Unlimited Transaction Volume: There are no limits on daily, weekly or monthly transaction volume.

-

One-time new account activation fee: varies from $99.00 - $1000.00 *depending on the merchant's website platform and coding requirements necessary for integration. *This non-refundable fee is collected upon onlyt after new account approval and execution of this agreement.

-

Transaction Fees: based on individual transactions. * For transactions of $1.00 up to $25,000 dollars a $1.56 authorization fee is required. Plus there is an Identification Verification fee of $1.63, and a $0.26 Signal Fee.

-

Fully compatible with popular shopping carts and website builders: - such as WordPress+WooCommerce, Shopify, 3dCart, Limelight, Magento, PrestaShop, Konnektive, OpenCart, CS-Cart, Big Commerce, and many more. Additional integration options include API and SDK.

-

API Integration Fee: $0.00 - $250.00. *This non-refundable fee is collected prior to providing services. It covers the manual labor of integrating your website into our payment gateway and access to PLAID API.

-

Risk Premium Fee: $0.00 - $500.00. *This non-refundable fee is collected upon execution of this agreement. It cover risks associated with providing this service including AML & KYC compliance.

-

Same day settlement of funds (depending on the time of purchase).

-

New Donations Platform: We've launched a powerful platform to streamline a merchants' fundraising and donation efforts. Sign up now to take advantage of the benefits.

Popular