How The EDGE Program Works

Offer a cash discount to non-card users while securing one low rate for every transaction. That way you can enjoy the same profit margins, regardless of whether customers pay with cash or credit. Edge is even compatible with our PayAnyWhere Smart Solutions.

Small and medium-size business owners who sign up for the EDGE Program by North American Bancard (now, called North™), can access a comprehensive suite of benefits designed to eliminate or substantially reduce credit card processing costs, increase profitability, and streamline operations.

If You Sell $250.00 Worth Of Product, You Keep $250.00

Eliminate Credit Card Processing Fees with the EDGE Program

The EDGE Program gives in-store customers the option to pay in cash or by credit card. It’s their choice.

- When paying by cash, the buyer enjoys a small cash discount.

- When paying by credit card, the store owner passes along the credit card processing fees to the cardholder.

This strategy of blending cash discounting with card brand compliant surcharging allows merchants to enjoy the same profit margin regardless of the payment method.

If you need more than one terminal, please contact us for price quote. No upfront or monthly costs for hardware; however, there is a $9.95 monthly software fee. You never pay for the hardware, just return it in good working order if you ever leave us.

Potential Benefits to a Retail Store Owner

- Totally Eliminate - or substantially reduce credit card processing fees.

- Increase Profit Margins - by passing card processing fees to the cardholder. Our smart point-of-sale terminals automate this process for you. With the EDGE program, the cost of accepting credit and debit cards is built into the posted price. When a customer pays with a card, they pay the listed price (which includes the processing fee).

- Enhance Cash Flow - Unlike card transactions which may take up to 48 hours to settle (or an entire weekend), EDGE cash discount puts money in hand today.

- Blazing Fast Deposits Of Card Transactions - With Next Day Funding, transactions processed and closed Monday – Friday before 10 p.m. ET will be deposited into your bank account by 10 a.m. ET the next business day. Our Same Day Funding allows you to have all transactions closed and processed before 10:30 a.m. ET deposited by 5 p.m. that same day.

- No Additional Fees: The EDGE program removes common monthly, annual, and compliance fees, so you’re not losing profit to hidden or recurring charges.

- Perfect Fit - for businesses with a high volume of small ticket transactions - like coffee shops, bakeries, food trucks, quick-service restaurants, and retail stores, where processing fees can quickly add up.

- Perfect Fit for Businesses Operating On Thin Profit Margins - where every dollar saved on unnecessary fees (like credit card processing fees) directly impacts profitability.

- Perfect Fit for Cash-Friendly Environments - Businesses where customers are accustomed to paying with cash or are motivated by discounts (e.g., dollar stores, smoke shops, gas stations).

- Perfect Fit for Professional and Home Services - Service providers such as plumbers, electricians, lawn care, and personal services (salons, auto repair) can also benefit, especially when billing for services rendered on-site.

The EDGE program is a dual pricing model that helps business owners increase profitability at the point of sale — regardless if customers pay by cash or card.

Six Powerful Benefits

Zero % Processing Fees

Retail stores large and small totally eliminate credit card processing fees at the point-of-sale.

Your Choice of 6 POS Terminals

Receives a FREE Verifone Vx520 swipe terminal or a portable Verifone Vx680 payment system, or PayAnywhere© Smart terminal.

FREE Marketing Tools

You are provided with FREE signage that explains the program to your customers.

No Sign Up Fee

No Sign Up Fee or Application Fee & No Long Term Binding Contract Required.

Dual Pricing Model: The EDGE program uses a dual pricing model to provide cash discounts to customers to choose to pay by cash rather than credit card or debit card. Our system automatically adjusts transactions based on the payment method to improve your profit margins.

Increased Profitability: The EDGE program is designed to help retail store owners increase profitability by offering customers the option to pay with cash and receive a discount.

Increased Profitability: The EDGE program is designed to help retail store owners increase profitability by offering customers the option to pay with cash and receive a discount.

Elimination of Credit Card Processing Fees: Regardless of whether a customer pays with cash or credit card, the EDGE payment processing system eliminates credit card processing fees.

Fairness to All Customers: The EDGE program is designed to be fair to all customers, as it rewards cash-paying customers with a discount while still allowing customers to pay with credit cards .

Substantially Reduce or Totally Eliminate Credit Card Processing Fees. Zero-fee processing, also known as no-fee processing, is a payment processing model where businesses don't pay transaction fees when accepting credit card payments. Instead, these fees are passed on to the customer, either through a surcharge or by offering a cash discount. This allows businesses to keep the full transaction amount without deductions.

Free Point-Of-Sale Equipment: North American Bancard offers free terminals that are Apple Pay ready and EMV compliant .

Free Signage:is provided to explain the program to customers.

Cost Recovery Without Raising Overall Prices: Instead of increasing prices for all customers to cover card processing fees, dual pricing allows merchants to offer a lower cash price while charging a slightly higher price for card payments. This means cash-paying customers get a discount, and card-paying customers cover the processing costs, creating a fairer pricing structure.

Improved Profit Margins:: By passing card processing fees only to card users, merchants can maintain or improve their profit margins without losing sales due to price increases across the board. This approach helps recover 70-90% of processing costs when implemented properly.

No Binding Contract Commitment: Flexibility to try the program without long-term obligations

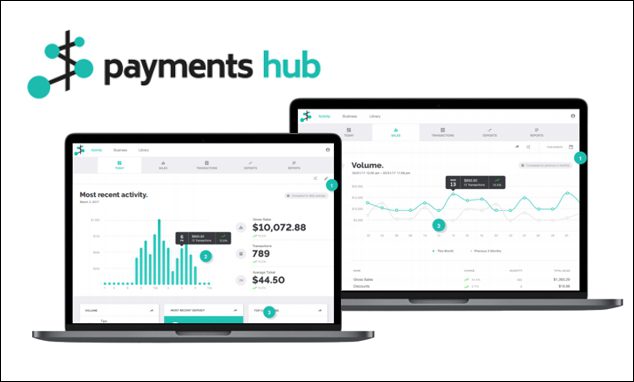

PayAnywhere Smart Terminals in combination with Payments Hub empowersbusiness owners with the ability to run their entire sales operations more efficiently. Business owners now have the ability to accept all forms of payments whether by card (credit or debit), eChecks, pay-by-bank, SMS text, email hyperlink, or by Virtual Terminal. On top of these robust payment capture and settlement capabilities — you receive, Payments Hub - an advanced payment acceptance dashboard with robust management tools—delivering real-time insights, flexible payment options, and seamless control over sales, staff, and inventory in ways not available from standard POS systems.

- All-in-One Mobility & Flexibility - *Accept payments anywhere: at the counter, table, or on the go, with both 4G and Wi-Fi connectivity. Sleek, portable hardware with a large touchscreen, built-in receipt printer, barcode scanners, and dual cameras for inventory management and rapid checkout.

- Business Management Integration * Real-time inventory tracking, sales analytics, and employee management directly from the terminal or via the PayAnywhere Inside portal—no need for separate software. Manage and track sales activity of individual waiters, sales reps, or vendors, enabling detailed performance insights and accountability.

- Seamless Customer Engagement - *Accept all major payment types: EMV chip, NFC/contactless, magstripe, and PIN debit, ensuring a frictionless customer experience.

- Payments Hub: Next-Level Back-Office Control

- Manage payments, view transactions, track inventory, oversee employee activity, generate reports, and handle disputes—all from a single, user-friendly online portal.

- Send invoices, set up recurring billing, and manage customer profiles with ease.

- Omnichannel Payment Collection - *Free virtual terminal included, enabling acceptance of online, phone, and card-not-present payments—expanding revenue opportunities beyond in-person sales.

- Innovative Payment Links - *Instantly create and share payment links for one-time or recurring payments via website, social media, email, text, or QR code—ideal for remote billing, fundraising, or flexible sales scenarios. This feature empowers businesses to get paid anywhere, anytime, without needing a physical terminal.

- Custom Alerts & Equipment Management - *Set up custom notifications, order supplies, and manage equipment warranties directly within the portal, streamlining daily operations.