Prepare for the FUTURE of global digital payments today

- 0% transaction fees

- Use any crypto wallet you want

- Peer-to-peer transactions (meaning, payments go directly from the customer to the seller/merchant)

- No middle-man

- No charge-backs. No identity theft.

- Refunds are provided ONLY if you wish to issue them

- Customers don't need to provide sensitive information

-

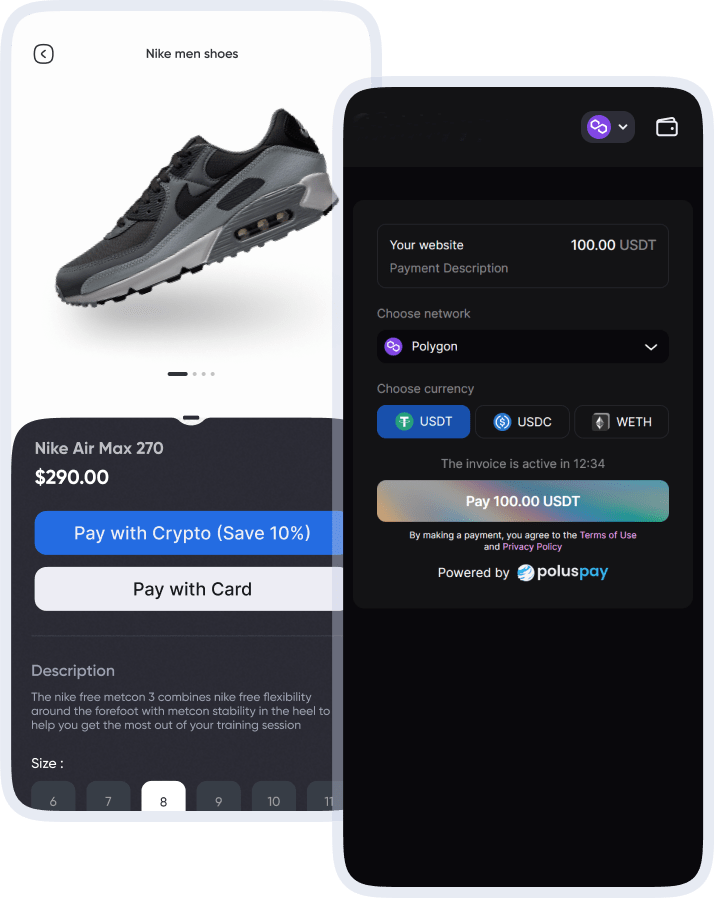

NO REDIRECTION OR DIVERSION AT CHECKOUT

Take cryptocurrency payments directly on your eCommerce store with a seamless and secure and checkout process. Your customer data stays with you and visitors remain on your site during the whole checkout process.

No KYC Mandates

No AML Requirements

If it's legal, you can sell it.

Know Your Customer (KYC) mandates are irrelevant here. We don't to inspect laboratory reports if you're selling CBD products, vape, kratom, or minor cannabinoids.

You decide what to sell, where to and how you want to get paid.

No Transaction Amount Limit

Receive or send digital currency payouts to employees, affiliates and sales agents around the world.

Up to $20,000 USD per transaction.

Within seconds cryptocurrency is automatically converted funds into a fiat currency of your choice.

Stablecoin Eliminates Volatility

Unlike cryptocurrency, stablecoin is pegged at a 1-to1 value equal to a US dollar or national currency.

This unique feature eliminates volatility during the exchange and conversion process.

This service is ideal for merchants who want to accept bitcoin/altcoins and cash out immediately.

Settlement Of Funds in Minutes

Our rates are fixed at 1.5% and funds settle within minutes.

There are no banks involved or middlement handling your money.

Customer transactions are sent through a secure blockchain network and settlement in digital wallet owned and controlled by you.

Our built-in autosettlement feature connects to any cryptocurrency exchange. Autosettlement instantly converts cryptocoin into fiat currency or stablecoin. No manual labor on your part.

“2015 has turned blockchain into something the industry has to live with.It is no longer a choice anymore.Recent news speculating about the identity of its creator and the formalization of virtual money as a commodity, just makes it more real than ever before.”~ Visa Corporation

Source: Nasdaq. "How Visa Is Embracing Both The Blockchain And Cryptocurrency". December 7, 2020.

The Largest Payment Processors In the World Are Flocking to Crypto

In August of 2019, Visa and MasterCard teamed up with over 70 crypto platforms to allow customers to spend cryptocurrencies across 80 million merchants globally.

In early 2022, payment giant Mastercard partnered up with Coinbase to allow users to purchase NFTs directly with their Mastercard debit and credit cards.

PayPal announced earlier in June, that it had deployed a payment gateway for U.S.-based users to easily transfer, send and receive cryptocurrencies.

Fully Decentralized Ramps

Decentralized monetary transactions via on-ramp and off-ramp refers to the processes of exchanging cryptocurrencies and stable-coin for government-issued fiat currencies such as the US dollar or vice versa.

An on-ramp is a platform that enables users to purchase crypto assets using a bank-issued debit card or credit card, while an off-ramp facilitates users in disposing of their crypto assets or exiting the cryptocurrency markets.

Dismissal of the interchange system

Decentralized stablecoin-to-fiat currency payment rails offer rates, fees, and settlement speed that leave traditional interchange systems crying in shame.

How? Because the blockchain network puts the sender and receiver on a real-time payment rail.

You Become The Bank

Familiarize yourself with two important terms; non-custodial and self-custodial wallet'.

These are software programs that allow you to store your cryptocurrencies and stablecoin on your device, such as your computer or smartphone.

Cutting edge Web3 non-custodial wallet gives users their own private keys, access to a decentralized exchange, and NFT capabilities. Examples of popular self-custodial wallets include RockWallet, Trust Wallet, Meta-Mask, and Coinbase Wallet.

Decentralized Payment Processing Is Here

Give website visitors the ability to shop and make payment with cryptocurrency, stablecoin, and all the other payment methods currently accepted. When a transaction is received, our system instantly converts a cryptocurrency payments into a secure stablecoin or a fiat currency of your choice.

Fiat Autosettlement

Please allow one business day for site configuration setup and testing.

Depending on the complexity of an eCommerce store, coding within the Checkout Page and unknowns, our developers may require up to 48 hours for completion of work.

Installation, Setup & Testing

Please allow one business day for site configuration setup and testing.

Depending on the complexity of an eCommerce store, coding within the Checkout Page and unknowns, our developers may require up to 48 hours for completion of work.

Safe from Hackers & Government Watch Dogs

A self-custodial wallet is a place where one can store, send, and receive a fiat digital currency. Very similar to an online bank account, a self-custodial digital wallet is simply an account that has a stored value of fiat currencies, stablecoin and crypto. Industry experts strongly recommend that you get a self-custodial digital wallet to ensure the safety and privacy of your assets.

Private keys are the most important part of owning crypto assets. If lost or stolen, your funds will be gone forever. Make sure to back them up securely offline and never share them with anyone, no matter how trusted they may seem.

Ways to store your private keys:

- Memorize them

- Write them on a piece of paper that you will not lose.

- Save them to USB Zip Drive

DISCLAIMER: KJ Proweb promotes decentralized banking products and merchant payment processing services provisioned and supported by licensed financial services companies. We do not sell investments, stock, futures, options, insurance, real estate, securities, or anything other than education on the potential benefits of decentralized on-ramp and off-ramp payment gateways. Past performance is not necessarily indicative of future results. By accessing any content on this site or related sites, you agree to be bound by the terms of service and privacy policy (located in the footer of this website). You should understand that there is an inherent risk in any banking service. For that reason, we cannot guarantee results or success.