It's the Game-changer No One Dares Talk About

Interchange Plus is the most transparent and cost-effective way to accept credit card payments. We offer Interchange Plus pricing to businesses that do not want hefty fees and surprise markups.

Say goodbye to hidden fees and surprise charges with our Interchange Plus Program. You only pay the true interchange rate plus a small, fixed markup, with no additional costs or percentage-based charges.

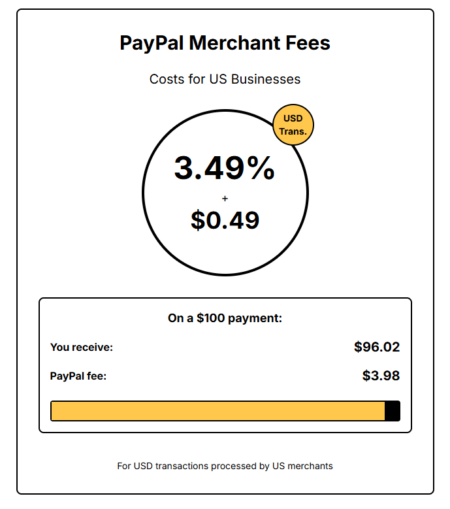

As of early 2026, standard U.S. PayPal business fees are around 2.99% + $0.49 for goods and services.

However, PayPal Pay Later (rates increase to 4.99% + fixed fee up to .49 cents per transaction).

Why this matters: This is the most important question because it reveals your processor’s true profit margin. In interchange plus pricing, you should get a clear answer like “0.30% + $0.10 per transaction.” If the processor can’t give you a straight answer or tries to complicate it, that’s a red flag.

What to look for: Competitive processor markups typically range from 0.20% to 0.50% plus $0.05 to $0.15 per transaction. Anything significantly higher means you’re overpaying. The beauty of interchange plus is that this markup stays the same regardless of card type, so you always know what your processor is making.

Why this matters: Some processors advertise low interchange plus rates to win your business, then raise their markup after a few months. You need to know if your rate is locked in and what triggers any potential increases.

What to look for: Get it in writing that your processor markup is guaranteed for a specific period, ideally the length of your contract. Understand whether your rates are reviewed annually and what performance metrics (if any) could earn you better rates as your volume grows.

Why this matters: True interchange plus pricing means you pay the actual interchange rates set by the card networks—no markups, no hidden padding. Some processors claim to offer interchange plus but actually mark up the interchange itself.

What to look for: Your processor should provide access to monthly statements that show the actual interchange categories for each transaction, matching exactly what Visa and Mastercard publish. You should be able to verify your interchange costs against the card networks’ published rate tables.

Why this matters: Some processors exclude certain transaction types (like keyed-in transactions, international cards, or chargebacks) from interchange plus pricing and charge flat rates instead, which defeats the purpose of transparent pricing.

What to look for: Every transaction should be processed at interchange plus your processor’s markup—no exceptions, no carve-outs. If certain transactions are priced differently, ask exactly which ones and why, then calculate whether this significantly impacts your total costs.

Why this matters: Interchange plus pricing should mean transparent transaction costs, but some processors layer on monthly fees, statement fees, PCI compliance fees, batch fees, and other charges that can add hundreds of dollars to your monthly bill.

What to look for: Get a complete fee schedule in writing. Common legitimate fees include PCI compliance (if you’re non-compliant), chargebacks, and monthly gateway fees. Be wary of excessive “junk fees” like statement fees, annual fees, or minimum processing fees that aren’t clearly justified.

Why this matters: The whole point of interchange plus is transparency. If you can’t easily verify that you’re being charged correctly, you’re not getting the benefit of this pricing model.

What to look for: Your monthly statement should break down transactions by interchange category, showing the exact interchange rate applied and your processor’s markup separately. The best processors provide online dashboards where you can see this data in real-time and export it for analysis.

Why this matters: Certain transactions can “downgrade” to higher interchange categories if they’re not processed correctly (missing data, delayed settlement, etc.). This costs you money. Good processors help you qualify for the lowest possible interchange rates.

What to look for: Ask if they provide Level 2 and Level 3 data processing for commercial cards, same-day settlement options, and guidance on how to qualify transactions at the lowest rates. Some processors offer downgrade protection guarantees or will audit your transactions to identify optimization opportunities.

Why this matters: Your business isn’t static. Understanding how volume changes affect your pricing helps you plan and negotiate better terms as you grow.

What to look for: With true interchange plus, your processor markup should stay the same regardless of volume, though you may be able to negotiate a lower markup as you grow. Be cautious of processors that increase rates if your volume drops—this punishes seasonal businesses unfairly.

Why this matters: This is your opportunity to see exactly what you’re signing up for before you commit. If the processor won’t provide a sample statement or can’t clearly explain charges, you’ll face the same confusion every month.

What to look for: A good interchange plus statement should be easy to read, with clear categories showing interchange fees, processor markup, and any additional fees. The processor’s representative should be able to explain every charge without hesitation. If they stumble or use vague language, consider it a warning sign.

Why this matters: You need to see actual savings projections based on your real transaction data, not hypothetical examples. A good processor will analyze your current statements and show you exactly what you would have paid under their pricing.

What to look for: Request a free statement analysis where the processor reviews 3-6 months of your actual processing history and calculates what you would have paid with their interchange plus pricing. This should reveal potential savings and identify any scenarios where you might pay more. If they won’t do this analysis, they’re either lazy or hiding something.

Tiered and flat-rate pricing makes processors significantly more money at your expense. Here’s why:

When you use a basic debit card, the actual interchange might be just 0.05% + $0.21. But if you’re on PayPal’s flat rate of 3.49% + $0.49, PayPal keeps the massive difference—over 3% on that transaction. They’re counting on you not knowing that most of your transactions actually cost much less than their flat rate.

With interchange plus pricing, processors can only mark up their own fee (typically 0.20% – 0.50%). They can’t hide their profit in the spread between cheap cards and expensive cards. Transparency reduces their profit margins, so many processors avoid offering it.

Tiered pricing and bundled rates are intentionally confusing. Processors use terms like “qualified,” “mid-qualified,” and “non-qualified” tiers without clearly defining them. This complexity makes it nearly impossible for merchants to comparison shop effectively.

When you can’t understand your bill, you can’t tell if you’re overpaying. When you can’t compare processors apple-to-apple, you’re more likely to stick with what you have. Confusion is profitable for processors.

Flat-rate pricing charges the same rate to a startup doing $1,000/month and an established business doing $100,000/month. This is fundamentally unfair to higher-volume merchants who should benefit from economies of scale.

Processors offering only flat rates aren’t interested in growing with you—they’re interested in maximum profit from small businesses who don’t know better. If a processor won’t offer interchange plus as you grow, they’re not a long-term partner.

Many processors specifically target merchants who prioritize “simplicity” over savings. While flat-rate pricing is simpler to understand, you’re paying hundreds or thousands of dollars per month for that simplicity.

It’s like buying a car and saying “I don’t want to know what the engine costs, the tires cost, and the labor costs separately—just give me one price.” Sure, it’s simple, but you’ll overpay dramatically and never know what you’re actually buying.

🚩 They can’t or won’t explain their pricing clearly

If a sales representative dances around your questions about interchange plus, uses vague terminology, or says “don’t worry about it, our rates are competitive,” walk away. Legitimate processors are proud of their transparent pricing and eager to explain it.

🚩 They only offer tiered or flat-rate pricing, even for high-volume merchants

Any processor that refuses to offer interchange plus to businesses processing over $50,000/month is deliberately overcharging you. There’s no legitimate reason to deny transparent pricing to established businesses.

🚩 They won’t provide a detailed fee schedule in writing before you sign

This is a massive red flag. If they’re hiding fees until after you’re under contract, you can guarantee those fees are excessive. Never sign a processing agreement without a complete, written fee schedule.

🚩 They advertise “interchange plus” but won’t specify their exact markup

Some processors use “interchange plus” as a marketing term without actually providing transparent pricing. If they won’t tell you their precise processor markup (e.g., “0.35% + $0.08”), they’re not offering true interchange plus pricing.

🚩 Their contract has automatic renewal clauses and high early termination fees

Processors confident in their value don’t trap merchants in contracts. If they’re charging $500 early termination fees and auto-renewing contracts for multiple years, it’s because they know merchants will want to leave once they discover they’re overpaying.

🚩 They won’t analyze your current statements to show potential savings

Processors offering genuine savings are eager to prove it by analyzing your actual data. If they refuse or make excuses about why they can’t do a statement analysis, they know their pricing isn’t competitive.

🚩 They bundle multiple services with unclear individual pricing

When processors bundle payment processing, POS systems, gateway fees, and other services into one monthly price without breaking down each component, they’re hiding excessive charges in the package. You should know exactly what you’re paying for each service.

🚩 Their sales pitch focuses on equipment or “free terminals” rather than processing costs

This is a classic bait-and-switch. They dangle “free” or discounted equipment while locking you into terrible processing rates. Your monthly processing fees will dwarf equipment costs, so never choose a processor based on hardware deals.