Google Pay is a digital wallet and payment method from Google that lets customers pay quickly using cards and accounts already stored in their Google account, both on mobile and desktop checkout pages.

Google Pay allows you to manage various kinds of payment methods and safely conduct transacts with third parties using credit cards, debit cards and checking accounts linked to Google Pay.

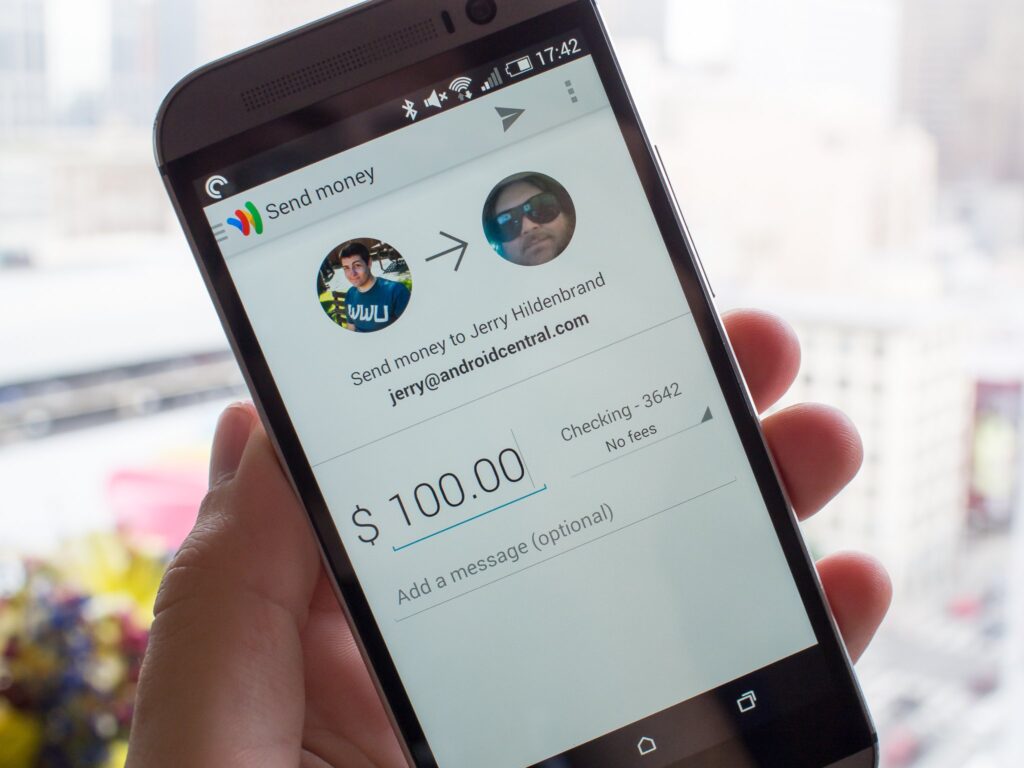

Yes, adults can use Google Wallet® (previously known as Google Pay®) to send money to friends and other Google Wallet account holders.

Peer-to-peer (P2P) transactions using digital wallets like Google Pay, CashApp, Zelle, and Venmo offer several key benefits:

1. Seamless and fast transactions: Users can quickly send money to friends or split bills with just a few taps on their mobile devices, eliminating the need for cash or complex banking procedures.

2. Secure payments: P2P money transfers prioritize security with robust encryption and authentication measures, protecting users’ financial information. Google Pay, for instance, uses multiple layers of tokenization and generates unique single-use tokens for each transaction, hiding the actual card number.

3. Convenient money transfer: Users can send money anytime and anywhere without needing physical bank branches or ATMs.

4. Low fees: P2P networks often feature lower transaction and currency conversion fees compared to traditional banking methods. Some platforms charge no fees, while others may add a small percentage to transactions[4].

5. Immediate fund availability: In many cases, funds transferred through P2P payments are available immediately, which is particularly helpful for last-minute payments.

6. Cost-effective: P2P payments can be more cost-effective than using traditional banks for sending and receiving money due to lower associated fees.

7. Wide compatibility: Google Pay, for example, is compatible with both Android and iOS devices, making it accessible to a broad range of users.

With Google Wallet®, you can sell online and get paid on the same day. There is no need to fill out mountains of paperwork only to get rejected after waiting days or weeks in vain.

After setting up your personal Google Wallet account, KJ ProWeb will integrate the API Code (HTML, JavaScript, and email subscription instructions into your website). The process takes approximately three hours.

Terms and Conditions of Purchase:

You, the Merchant/Applicant agree to indemnify, defend, and hold harmless KJ Proweb, its officers, directors, agents, subcontractors, and suppliers from and against any lawsuit, claim, liability, loss, penalty or other expense (including attorneys’ fees and cost of defense) that you may suffer or incur as a result of a bank, ISO/MSP’s inability to delivery merchant processing services as described in an Enrollment Application for Service.

This indemnification and waiver of liability include, but shall be not limited to (ii) unforeseen actions on the part of federal government agencies or credit card brands that could place certain products into a high risk or prohibited category thus prevent your ability to receive merchant processing.

Service Disclaimer: Under no circumstances does submission of an application, payment of bank or ISO imposed application fees, payment for state-issued business licenses, seller’s license, off-shore hot desk (if applicable), or any other fees — guarantee approval of your merchant application. The ISO/sales agent shall not be held liable for costs, fees, business expenses or any losses if an application for service is declined.

If you, the Merchant / Applicant do not agree with or accept this Indemnification and Waiver of Liability in its entirety, do not apply for service.