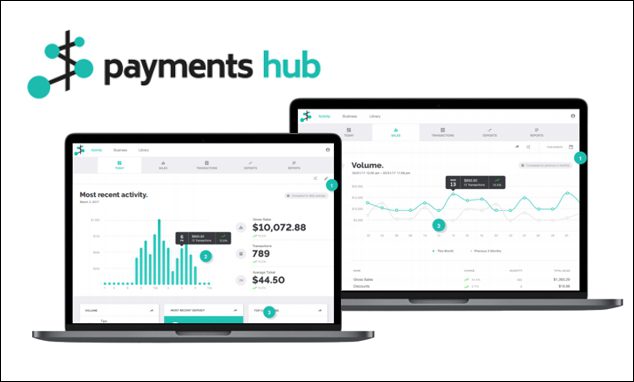

Small and medium-size business owners who sign up for the EDGE Program by North American Bancard (now, called North™), can access a comprehensive suite of benefits designed to eliminate or substantially reduce credit card processing costs, increase profitability, and streamline operations.

If You Sell $250.00 Worth Of Product, You Keep $250.00

Eliminate Credit Card Processing Fees with the EDGE Program

The EDGE Program gives in-store customers the option to pay in cash or by credit card. It’s their choice.

This strategy of blending cash discounting with card brand compliant surcharging allows merchants to enjoy the same profit margin regardless of the payment method.

The EDGE program is a dual pricing model that helps business owners increase profitability at the point of sale — regardless if customers pay by cash or card.

Retail stores large and small totally eliminate credit card processing fees at the point-of-sale.

Receives a FREE Verifone Vx520 swipe terminal or a portable Verifone Vx680 payment system, or PayAnywhere© Smart terminal.

You are provided with FREE signage that explains the program to your customers.

No Sign Up Fee or Application Fee & No Long Term Binding Contract Required.